2021 tax return estimate

The IRS began accepting 2021 income tax returns on Jan. Use our simple 2021 income tax calculator for an idea of what your return will look like this year.

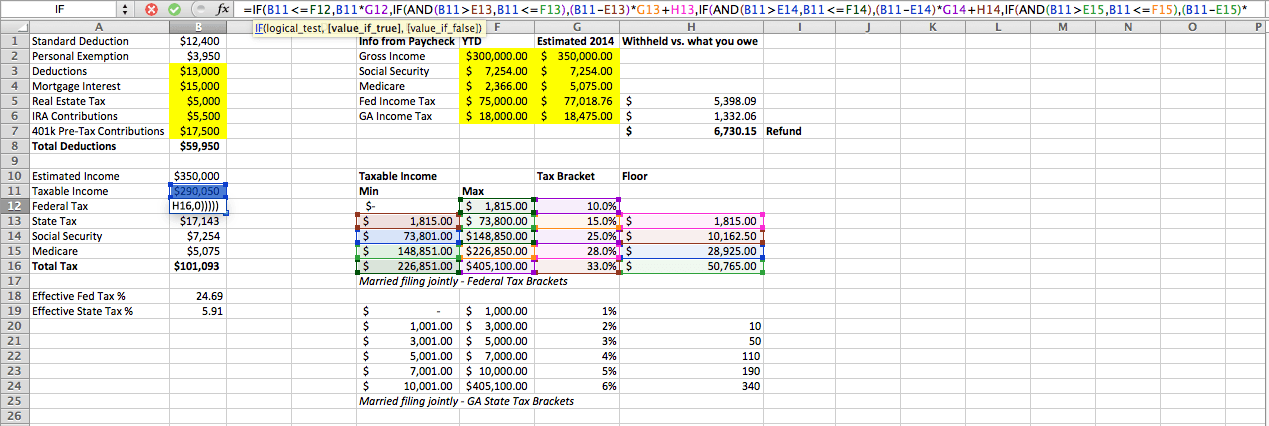

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

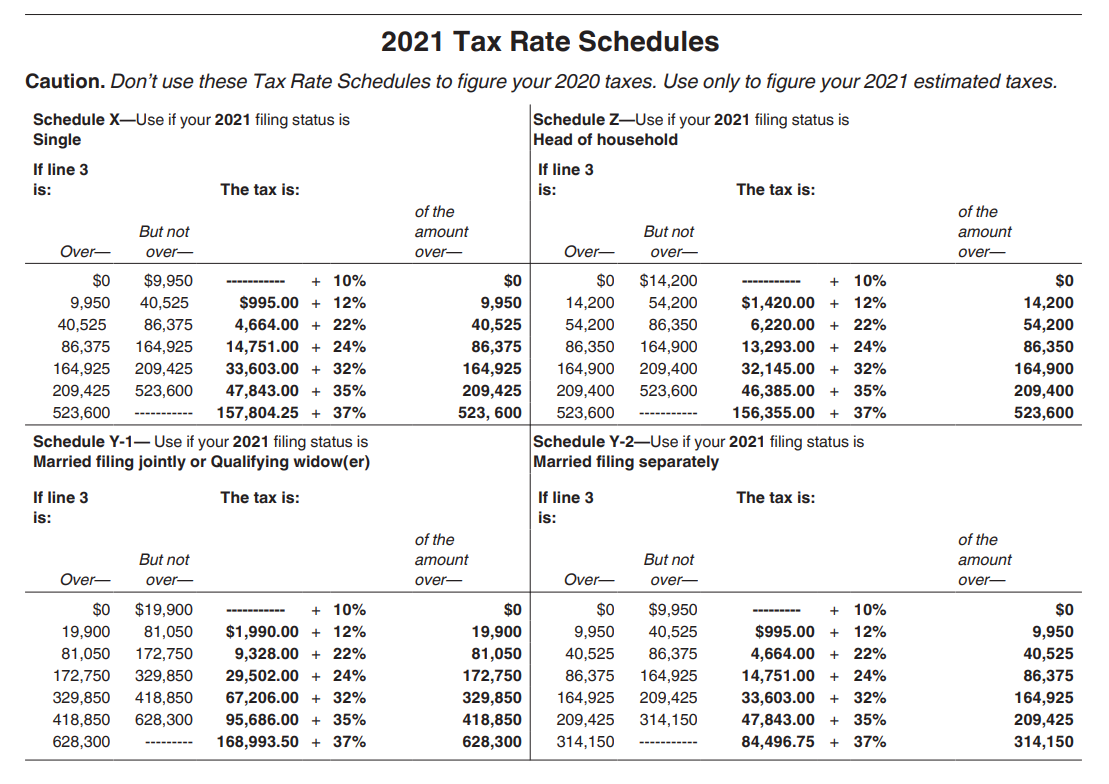

Here is how your income would apply to the new rates.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Individual Estimated Income Tax Payment Small Business Income Tax Return Arizona Form 140ES-SBI DO NOT STAPLE ANY ITEMS TO THE FORM. Ad Use our tax forgiveness calculator to estimate potential relief available.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Including a W-2 and. 100 of the tax shown on your 2021 return.

Use this tool to. Youll get a rough estimate of how much youll get back or what youll owe. Estimate Today With The TurboTax Free Calculator.

Use this free tax return calculator to estimate how much youll owe in federal taxes using your income deductions and credits in just a few steps. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Read customer reviews find best sellers. Over 9950 but not.

Use this Calculator for Tax Year 2021. And is based on the tax brackets of 2021 and. Estimate your 2021 tax refund today.

Gather your required documents. Estimate your 2021 Return first before you e-File by April 18 2022. Up to 10 cash back Tax Brackets Your tax bracket shows you the tax rate that you will pay for each portion of your income.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. How does the tax return estimator work. October 17 2022 - File extended 2021 tax return.

Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. 2021 Returns can no longer be e-filed as of October 17 2022. Have the full list of required tax documents ready.

Ad Use Our Free Powerful Software to Estimate Your Taxes. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with. If you chose to file an extension request on your tax return this is the due date for filing your tax return.

Ad See How Long It Could Take Your 2021 State Tax Refund. Start a New 2021 Tax Return. No More Guessing On Your Tax Refund.

As you make progress the taxes you owe or the. Enter your tax information to the best of your knowledge. Then income tax equals.

Estimate your federal income tax withholding. 10 of the taxable income. Worksheet Arizona Form 140ES-SBI.

See how your refund take-home pay or tax due are affected by withholding amount. It is mainly intended for residents of the US. Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

Ad Access IRS Tax Forms. Estimate Today With The TurboTax Free Calculator. Please note this calculator is for the 2022 tax year.

IRS tax forms. Browse discover thousands of brands. If taxable income is.

If your taxable income is less than 126000 you will get some or all of the low and. You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. For example if you are a single person the lowest possible tax.

Complete Edit or Print Tax Forms Instantly. Beyond this date use the 2021 Tax Return Calculator below to estimate your return before filling in the forms online. See What Credits and Deductions Apply to You.

Enter Your Tax Information. Know your estimated Federal Tax Refund or if you owe the IRS Taxes. January 18 2022 - 4th Quarter 2021.

Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc. Estimate the areas of your tax return where needed. No More Guessing On Your Tax Refund.

The base amount for the 202122 income year has increased to 675 and the full amount is 1500. It is mainly intended for residents of the US. And is based on the tax brackets of 2020.

You must either file an amended 2020 tax return or file a new 2020 return if you did not file a tax return for that year. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

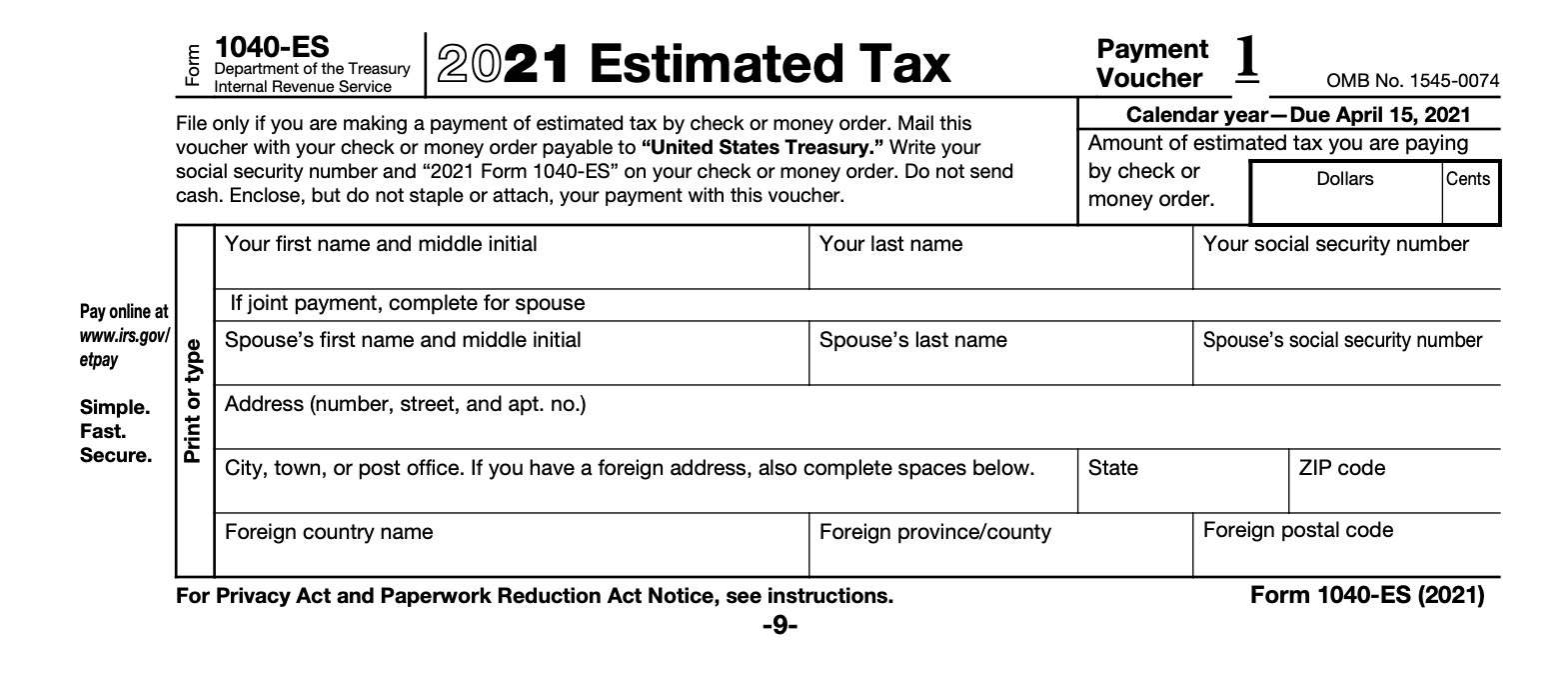

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Ontario Income Tax Calculator Wowa Ca

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

How To Estimate Your Taxes To Extend Filing Deadline Forbes Advisor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

2020 2021 Tax Estimate Spreadsheet Interactive Lesson Plans Higher Order Thinking Skills Student Orientation

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Year 2022 Calculator Estimate Your Refund And Taxes

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition